In this post, we will discuss the limited circumstances in which applicants may request a fee exemption for Form I-765 filed in connection with a renewal request for consideration of Deferred Action for Childhood Arrivals (DACA).

In most cases the filing fee to request a renewal of Deferred Action for Childhood Arrivals cannot be waived, but fee exemptions are available in the following limited circumstances:

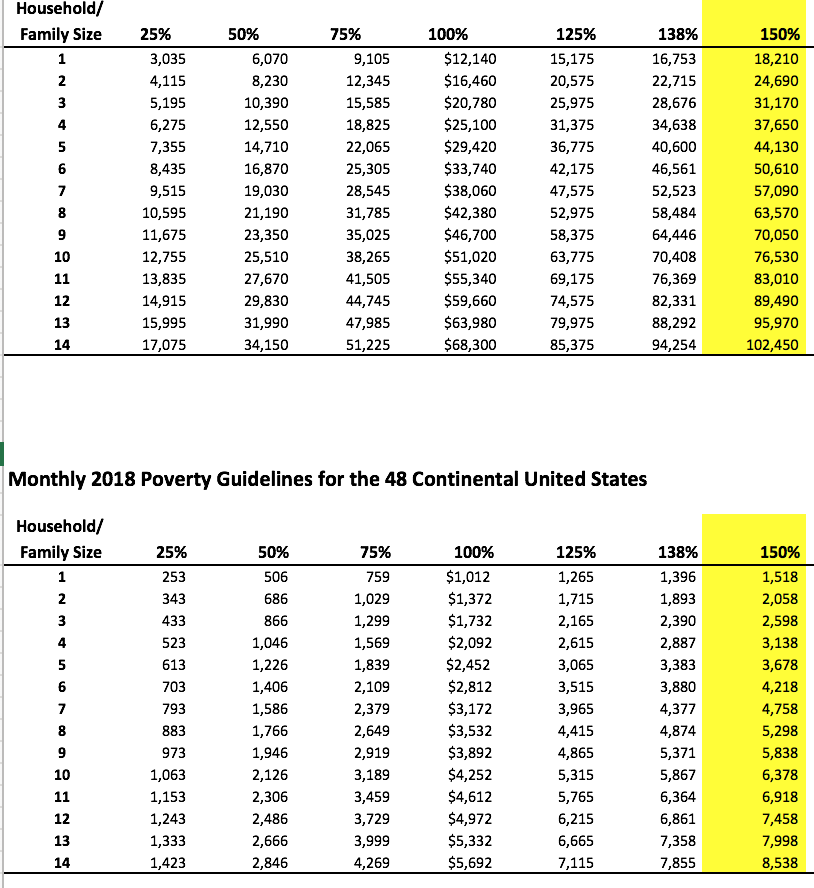

- Applicants under 18 years of age who are homeless, in foster care, or otherwise lack parental or other familial support, with income that is less than 150% of the U.S. poverty level may seek a fee exemption

- Applicants who cannot care for themselves because of a serious chronic disability with an income that is less than 150% of the U.S. poverty level may claim a fee exemption

- Applicants, who at the time of their request, have accumulated $10,000 or more in debt in the past 12 months, as the result of unreimbursed medical expenses for themselves or family members, receiving an income that is less than 150% of the U.S. poverty level may claim an exemption of the filing fee

To determine whether your income is less than 150% of the U.S. poverty level please reference the chart below:

In order to be considered for a fee exemption, applicants must submit a letter and supporting documentation demonstrating that they fall into one of the above-mentioned categories. Applicants must first file a request for a fee exemption and receive an approved fee exemption, before filing a request for consideration of deferred action on Form I-821D. Applicants may not submit Forms I-821D, I-765, and I-765WS without a record that a fee exemption has been approved.

Visa Lawyer Blog

Visa Lawyer Blog